Ross Eventon*

In a recent report for GDPO, I discussed the links between national economic models and illicit cultivation, and the way this important context has been largely ignored by the drug policy community; localised projects – amounting to rural development aid – have instead been the focus of attention. In this blog I would like to address an important but often overlooked issue: the way the proceeds from criminal activity interact with the national economic model, and vice versa. The focus will be on the kinds of “Washington Consensus” reforms that have been applied in many developing countries since the 1970s.

In 1994, the US Drug Enforcement Administration produced an interesting report on this topic, looking at the case of Colombia. The report opens with the following statement:

“Like many Latin American countries, Colombia recently has liberalized its economy through a series of reforms and relaxed import restrictions on foreign goods and services. Although Colombia may be benefiting from the resultant increase in international trade and exchange, criminal elements, including major drug kingpins, also are profiting from liberalization of the Colombian economy.”

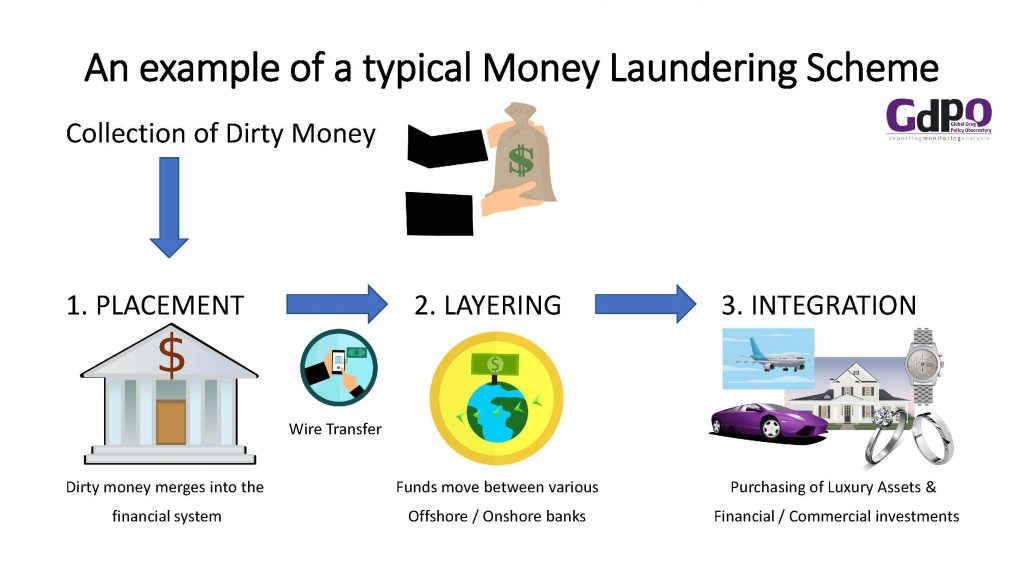

The liberalisation of the financial services sector and the privatisation of many commercial facilities gave traffickers a new means of laundering their income. These reforms, the report notes, “will make it much more difficult for drug law enforcement officials to conduct financial investigations pertaining to drug money laundering in Colombia as well as in other countries.”Cases soon emerged of drug money being laundered through privately owned currency brokerage houses. The reforms also allowed Colombian citizens to hold dollar accounts. This meant “hundreds of millions of dollars worth of drug-related U.S. currency has been flowing into Colombia.”[1] When the government issued fixed-rate treasury securities, “these securities were sold to Colombian investors and informed sources reported that some securities were purchased with drug money.” The report comments:

Ironically, a large percentage of the foreign currency reserves that are flooding the Colombian Government’s international reserves accounts (especially the majority of U.S. dollars) are believed to stem from the repatriation of drug proceeds from U.S. and European drug markets. The revenue generated by the influx of drug proceeds into the economy has provided the Colombian Government with funds for debt payments and national infrastructure development. Furthermore, through the purchase of government-issued securities, Colombian drug kingpins are investing in their country’s future economic development.

The implications of an inflow of large amounts of US dollars could be significant, for a number of reasons. The dollar flow removes one of the persistent problems of developing countries: the shortage of foreign reserves necessary to finance imports, particularly of machinery and other capital goods needed for the development of domestic industry. Under normal circumstances, this leads to pressure to either increase exports – usually of raw materials – in order to earn the necessary currency, or to take measures to depress national demand, causing imports of consumer goods to fall (a currency devaluation, which also decreases real wages, could have such an effect).

In Colombia, the enormous amount of dollars entering the reserve accounts eliminated this balance of payments problem. In other countries, the shortage of reserves could serve as an incentive to improve the economic structure, particularly domestic export capabilities, which would create new sources of foreign exchange. In Colombia there was no such pressure. In fact, the government was able to run persistent current account deficits – imports exceeding exports – because the capital account was in surplus, thanks to the revenues from the drug trade. The DEA report refers to this as “the substitution of export revenue with revenue from illicit sources.”

In 1996, a UNODC study noted that:

In situations of reduced money growth, an infusion of hard currency can bolster a country’s foreign reserves, ease the hardship associated with expenditure-reducing policies, and moderate foreign indebtedness. Drug money could in this light be perceived as a potentially stabilizing force, a source of capital without the strings of conditionality attached … Clearly, there are “benefits” which accrue to countries which serve as reservoirs of the revenues from the international drug trade.

After the economic liberalisation in Colombia, there followed a boom in private spending – and indebtedness – and, later, government deficits. A study of this period by the Banco de la Republica, which makes no mention of illicit incomes, instead discussing “hidden capital inflows,” remarks:

Both the rapid process of fiscal deterioration and the excess of private expenditure over disposable income were greatly facilitated by huge foreign capital inflows. They allowed the economy to keep a large and increasing current account deficit of the balance of payments between 1992 and 1997. At the same time, they implied that, during most of the nineties, the foreign exchange market was characterized by excess supply of dollars and by a pressure towards a real appreciation of the Colombian peso. A vicious circle was then created. The process of appreciation of the peso promoted a further increase in expenditure and made it apparently cheaper to increase foreign indebtedness and to bring foreign assets into the country.

From a development perspective, this is a crucial issue. The demand for the domestic currency, as traffickers convert dollars into pesos, causes it to appreciate.[2] As the OAS has recognised, “The influx of large volumes of foreign exchange directed toward activities showing sudden, artificial growth could cause the currency to appreciate and produce “Dutch disease”-type consequences by making other legitimate activities less competitive.” The appreciation will make imports cheaper, but it will also mean exports are less competitive. Domestic industries, particularly manufacturing, will find it difficult to compete internationally, given the relative increase in the price of their goods. If the appreciated exchange rate persists, domestic industry could suffer significant losses. The DEA report, in fact, had observed this unfolding anti-development tendency: “The appreciation of the peso and subsequent increase in the peso’s “real value” have significantly hurt manufacturing and agricultural producers in Colombia.”[3]

In the 1990s, the appreciated peso led to inflationary pressures, and the government responded by contracting the money supply. “However, due to the constant flow of drug dollars, this action caused the value of the peso to appreciate and, in turn, domestic production costs have increased. This increase has reduced demand for export from overseas markets; at the same time, the stronger peso has increased demands for imports.”

In this sense, the presence of drug trafficking on the national territory is similar in development terms to a low-value export industry or unproductive Foreign Direct Investment (FDI): While it provides foreign reserves, the revenues are not invested in productive capacity. Drug money is traditionally laundered through real estate (a hedge against inflation), casinos, car dealerships, construction, and so on. Any associated increase in demand is consumption-based and unsustainable. Hence Medellin once experienced enormous investments in the construction sector linked to the drug trade. But once the boom subsided, the city “suffered an economic decline and high unemployment because little alternative productive investment had been made.” Similar tendencies have been noted in other regions by the UNODC:

In West Africa, in recent years, significant amounts of criminal money seems to have been invested in the construction of casinos. Recent examples of arms and drug dealers in some of the western Balkan countries revealed major investments in large-scale construction, ranging from apartment houses, shopping malls and business centres to yacht ports, officially financed by foreign banks, though with criminal funds.

These kinds of consumption patterns, created by illicit income, mimic the historic problem of Latin America: the wasteful use of much-needed foreign currency to purchase luxury goods from abroad. The DEA report, for example, found “the importation of luxury goods by Colombia and their subsequent sale has increased suspiciously by 105 percent since 1992. Many of the purchases have been luxury automobiles and four-wheel-drive vehicles that have saturated the Colombian automobile market.”

In 1991, a New York Times article noted that drug trafficking in Colombia was contributing to deindustrialisation and, therefore, unemployment in the manufacturing sector:

A big problem is that the drug profits are repatriated as contraband goods. Colombia’s two largest cities, Bogota and Medellin, have large shopping centers, both called San Andresito after Colombia’s San Andres Island in the Caribbean. Most contraband passes from the island to these bulging inland malls. Contraband sales are estimated at $1 billion a year. But the large contraband trade has contributed to the country’s “disindustrialization,” a study by the Bogota economic research group Fedesarrollo, has found. Local industries compete with the goods and are consequently forced out of business. And the drug barons walk away with local currency to spend on luxuries: fleets of sports cars and motorcycles, exotic animals and art works. Since most of those goods are imported, there is no expansionary effect on the Colombian economy.

Today, the estimates of the value of illicit financial flows related to drug trafficking in the western hemisphere are between $80 – $90 billion a year; enough, that is, to have an impact on currency values or influence macroeconomic policy.[4] One of the obstacles to combatting these illicit financial flows is that traffickers now take advantage of the same mechanisms used by the very wealthy and corporations, including tax havens. To crack down on laundering of illicit gains would mean addressing the loopholes in the legal system which allow for financial secrecy. A drug trafficker, for example, will launder money using the same means as a corporation sending bribes to government officials. As one study observes, while officials have constantly promised reform, “We have waited long enough now to conclude that they are insincere.” The American justice system in particular demonstrates “a curious indifference to white-collar crime.”

Another UNODC study has discussed the way drug trafficking – through its macroeconomic effects and, citing the DEA, “short-run positive effects” – can influence policy decisions:

[T]he political dilemmas posed by the illicit drug industry are not limited to personal enrichment. For some Governments, even with the best of intentions, worsening terms of trade mean that hard currency revenue – drug-tainted or not – have special appeal even at the official level. For those faced with seemingly untenable debt-servicing burdens, drug money can be seen as a panacea for a vast array of other public commitments. In 1992, the proportion of external debt to GNP was 84 per cent for Bolivia, 48 per cent for Pakistan, 95 per cent for Peru and 386 per cent for Zambia. In such desperate situations, officials find themselves caught in a dilemma between looking the other way in order to finance governmental expenditures and enforcing laws against drug trafficking. In financial markets, Governments often find themselves in an analogous situation: by relaxing controls and establishing safe-money havens in order to woo investors, they run the risk of attracting illicit funds, losing creditworthiness and lowering prospects for long-term financial stability.

Drug trafficking, therefore, may lead to circumstances that condition the kinds of macroeconomic policies that are pursued. And there may be other ways in which economic reforms benefit local groups reliant on illicit incomes. The obvious example is Afghanistan. Soon after the occupation, the country adopted – or, more correctly, the occupying forces and the international financial institutions imposed – an economic model based on the “Washington Consensus” reforms.[5] A long-recognised effect of a free trade regime in a poor country is that it will hold in place the existing production structure: a country that exports rugs and grapes, and adopts free trade, will most likely be exporting the same kinds of products ten years later. The economic model, noted a World Bank report, had led to a “market-oriented overall policy environment, few legal constraints on labour markets, and a generally untrammelled informal sector.” Commenting on the beneficiaries of such a model, Erik Reinert, an economic historian and development economist, writes: “Warlords in the world periphery may appreciate free trade [because it] locks a nation in a pre-capitalist and backward economic structure that prevents democracy.”

The privatisations and the economic liberalisation that followed the occupation of Afghanistan were, it seems, a great boon to the political and business elite involved in the drug trade. There are other dynamics to be considered. In Colombia, for example, the paramilitary forces are financed by the drug trade. These groups have historically been the shock-troops of the government’s economic model. By assassinating trade unionists, they contributed to the extremely low rates of union membership and stifled calls for changes in the economic model. The murder of progressive politicians, by paramilitaries and traffickers, had a similar effect. Land grabs by paramilitaries also helped consolidate land ownership and the model of development based in large part on oil, mining and monoculture; studies have even shown that “violence perpetrated by armed groups sympathetic to the interests of the oil sector – namely, the public armed forces and right-wing paramilitaries – have facilitated FDI in Colombia’s oil sector.” We therefore have a self-reinforcing system: an economic model beneficial to criminal groups, combined with violence funded by illicit income that serves to perpetuate that model. A coalition of NGOs in Colombia have referred to the national economic model as “pro-rich.” For a number of reasons outlined here, it may also be “pro-criminal.”

In my report, I discussed another neglected area: the relationship between economic reforms, deindustrialisation and criminal gangs. Throughout Latin America, economic liberalisation has led to the decline of manufacturing industries that were a source of relatively well-paid jobs. Medellin, for example, was once an important textile centre. When the industry disappeared, young people were left with few viable options for employment. Criminal gangs offered an alternative. Similar phenomena are observed across urban areas of Latin America. And the same issues exist in the countryside: it is in the interest of the traffickers and their facilitators to have a large proportion of farmers rely on an illicit cash crop in order to survive.

Identifying the sources of such problems guides us towards possible solutions. As I write in the policy brief:

“From the perspective of a development economist, the fact that in Guatemala City thousands of young men decide to join local gangs cannot be separated from a production structure which revolves around exports of bananas, coffee and sugar. In Colombia, the key to the perennially high levels of coca cultivation is the government’s exclusionary economic model focused on extractive industries, monoculture and finance, which cannot absorb the labour abandoning the countryside and leaves around half the working population in the informal economy. If Afghanistan continues to focus on exporting carpets, rugs and dried fruits, its farmers will never have any other option than to produce illicit crops to survive.”

Read the full Policy Brief: Drug Policy and the Development Fallacy

*GDPO Research Associate

[1] A related issue is the liberalization of capital accounts, a policy that has been embraced by a number of developing countries. These measures increase the economic vulnerability of a country, and go far beyond the original recommendations of the so-called ‘Washington Consensus’. Allowing the free flow of capital out of the country grants investors the power to ‘discipline’ governments who make economic policy decisions to which they are opposed. It will also facilitate money laundering. As one study notes, capital account liberalization should not take place until the government has made sufficient strides against “corruption, crime, illegal businesses and money laundering.” This was clearly not the case in countries like Colombia or Brazil. http://www.unece.org/fileadmin/DAM//ead/ptepf/daianu_ptepf_28_06.pdf

[2] In Colombia, foreign currency, primarily dollars, flooded the black market. And this caused an inversion of the normal arrangement: buying pesos on the black market was more expensive than the official rate. This suggests a surplus of foreign currency, and a willingness of traffickers to pay a premium to convert their currencies, without uncomfortable questions being asked.

[3] And, it should be remembered, what harms agriculture is beneficial to those who need farmers to rely on illicit sources of income to survive.

[4] One of the results of the pandemic has been a worldwide increase in cash holdings. Part of this development could be attributed to less retail activity, meaning criminal groups have been unable to launder their money, and are forced to hold cash. See here for discussion.

[5] For an excellent analysis, see: Del Castillo, G. Guilty Party: The International Community in Afghanistan, Xlibris Corporation, 2014